Assessing market cycles and risk is a necessary component of any investment strategy. Whether in a positive or negative cycle, there are opportunities in real estate beyond the “buy low; sell high” saying, depending upon long-term goals. However, it is much easier to assess previous trends. It is difficult to predict the future; otherwise, everyone would have predicted the market crash of 2008. To measure performance, we should look at how real estate compares to historical and emerging data, as well as other securities to mitigate risk.

Historical Data

Historical data includes sales information, vacancy rates, and interest rates. Sales data is widely used by the appraisal methods as it gives an indication of where property values have been. The downside is that sales comparables are often lagging and may not keep up with immediate corrections in the marketplace. Vacancy rates can tell us whether there is an surplus of spaces.

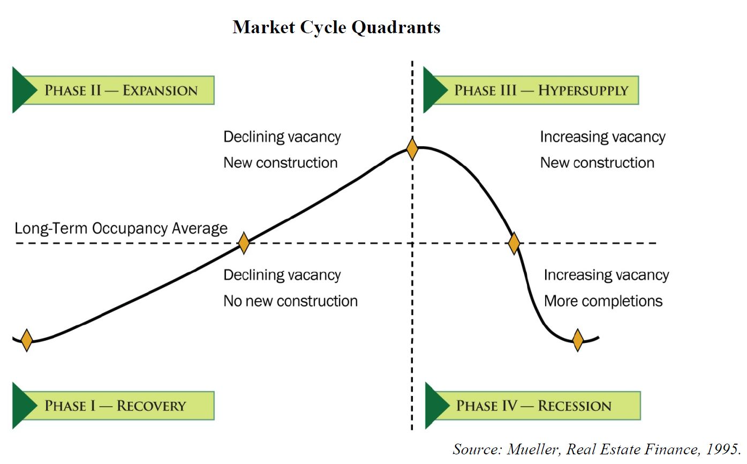

A great example is provided by Harvard Market Cycle Quadrants using vacancy and construction to show phases of the market cycle. If an increase in vacancy in a specific market is starting to occur, we may consider this phase to be an indication of an impending downward trend. Often new construction falls behind market phases. Once the market is in an expansion phase, companies look to new construction to capitalize on investment momentum. However, construction often takes time including design, permits and production. By the time the new product hits the market, there could already be a change in the cycle or even cause a change by increasing available units.

Another trend to look at is interest rates. When the Federal Open Market Committee raises rates, it affects the housing economy as well as investment properties. Generally as interest rates rise, a negative impact on residential properties will occur. Monthly payments increase and thereby affect affordability. As expected appreciation decreases, the desire to own may also decrease. And of course, interest rates affect investment yields. As the cost of borrowing increases, expected rates of returns must also increase. Recently, we have seen interest rates already increase with anticipated additional rate hikes throughout the year.

Securities

The risk of investing in real estate also must also be compared with returns on other security investments such as bonds, stocks, and treasury bills. Recently, the rates on treasury bills have increased, making those more appealing to more risk adverse investors. T-bill rates impact real estate income yields as investors then expect higher returns when compared to the benchmark of a riskless investment.

REITs are an alternative source of offsetting risk by investing in portfolio holdings and different asset types. Many of our clients are REITs and have positioned their success on the ability to purchase our value-add retail listings thereby increasing yield.

What is the future real estate outlook?

Using some of these indicators we make more informed predictions about the future of expected returns. While purchasing real estate always entails some risk, it also comes with reward. From at least 1985-2009, real estate investments exceeded the rate of inflation and produced investment returns. Increasing returns is also a hedge against concerns about inflation. While uncertainty in the market can be a factor affecting values, knowing how to analyze the trends can help offset volatility.

Our team is uniquely qualified to walk investors through multiple retail assets from single tenant, multi-tenant, to grocery anchored power centers and properly position dispositions ahead of the market curve.